Many founders and HR leaders come to Indonesia with a simple assumption: “If engineer salaries are lower, our total cost to hire will also drop.”

In practice, once they start working with traditional recruiters or a DIY + recruiter mix, the invoices that show up often look very different from what they expected.

The most frustrating part is not just the number on the invoice, but the lack of a clear picture from day one: what is your real cost per hire, which fees are hiding behind the first quote, and at what point a traditional recruiter becomes more expensive than working with a long‑term talent partner.

Many teams reach this point and realize they need numbers, not guesses. Rather than spending two or three months guessing how these cost structures work, many founders find it easier to sit down with a team that sees real‑world cost‑per‑hire data in Indonesia across different hiring models every week.

Schedule a 30‑minute cost breakdown call with RainTech to compare the cost of hiring in Indonesia via recruiters, DIY, and a talent partner for your specific role.

Why Recruiter Fees in Indonesia Often Surprise Founders

On the surface, many recruiters in Indonesia look budget‑friendly because local salaries are lower than in the US or Europe.

A 15–20% fee can sound harmless when you only see the percentage, especially if you compare it to recruiter fees in your home market. Once you translate that percentage into actual currency for a mid‑level or senior engineer, and then multiply by more than one hire, the picture can change quickly.

Founders are also often surprised by how many times they have to rerun a search. When a hire leaves in the first few months, you may get a replacement, but you still lose onboarding time, team focus, and runway without much warning.

And because most recruiters are laser‑focused on filling seats, they are rarely incentivized to design an employment setup that keeps Indonesian engineers engaged and compliant for years, not just months.

If you want to see how hiring costs in Indonesia go beyond salary and touch recruitment, overhead, and hidden risk, you can later connect this article with Maximizing Cost Savings and Business Impact Through Remote Hiring in Indonesia.

The Three Recruiter Cost Models You will Run Into Most

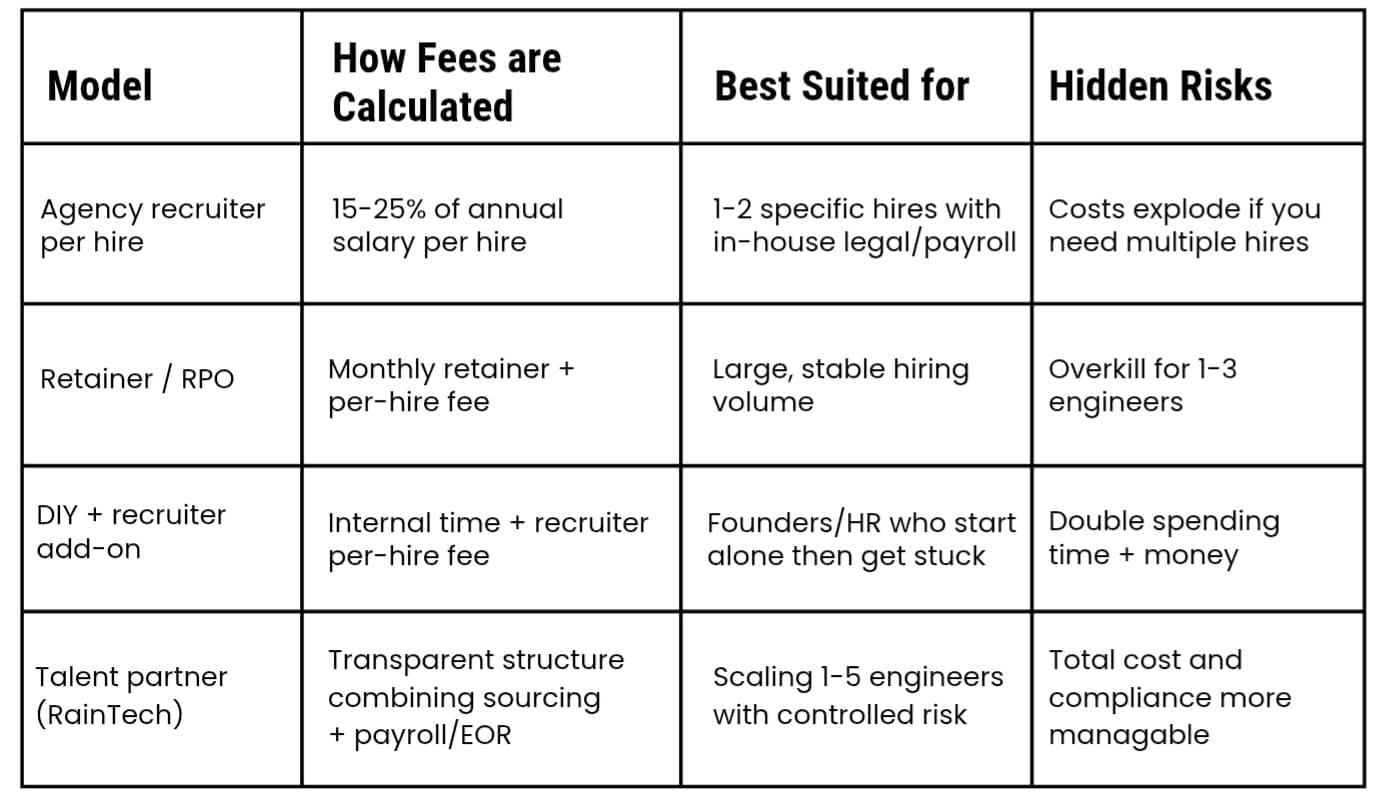

Agency Recruiter with Per‑Hire Fee

- How it works: The recruiter charges a fee as a percentage of the candidate’s annual salary, and you pay when the hire is made. In Indonesia, the percentage can look smaller than in your home market, but it still scales directly with seniority and compensation.

- Where it breaks down: As soon as you plan to hire multiple engineers in 12–18 months, these per‑hire fees start to stack. You end up paying full placement fees each time, while still carrying all the ongoing responsibilities for contracts, payroll, and compliance yourself.

- Why it seems fine at first: For a single, urgent role, a one‑off fee can feel like a reasonable trade-off to get someone in the seat quickly. If you already have local legal, payroll, and HR in place, it can slot into your existing structure without major changes.

Retainer / Recruitment Process Outsourcing (RPO)

- How it works: You pay a monthly retainer for a dedicated recruitment function, often with additional per‑hire fees. This can give you predictable capacity and a more embedded recruitment process.

- Why it seems attractive: For companies with large, steady hiring pipelines, having an external team to run sourcing, screening, and coordination can remove a lot of operational load. You effectively “rent” a recruitment engine without hiring a full in‑house team.

- Where it breaks down: If you only need one to three engineers, you are paying for capacity you rarely fully use. The retainer can quietly become a fixed cost that is hard to justify at early‑stage, especially when it does not include the legal and payroll layer you still have to build separately.

DIY First, Recruiter Later

- How it works: You start by posting jobs, doing outbound outreach, and screening candidates yourself, then bring in a recruiter when things stall. This feels scrappy and budget‑friendly at the start, especially if you are used to doing everything in‑house.

- Where it breaks down: By the time you call a recruiter, you have already spent weeks of founder or HR time on sourcing, interviews, and coordination. When the recruiter invoice arrives on top of that, the true cost per hire includes both your internal time and the external fee, often without dramatically better retention.

- Why it seems logical: Early‑stage teams often want to stay close to hiring, and they underestimate how much time sourcing in a new market will take. It feels natural to “try on your own” before involving external parties.

Summary Table: Recruiter Cost Models vs Talent Partner

This table is only the starting point. The real question is how each model behaves over a 12–18‑month horizon, how predictable your spend is, how much leadership time gets absorbed, and how much legal and compliance risk sits on your side of the table.

The Core Problem: Recruiter Fees Only Cover the Surface

Traditional recruiter fees essentially buy you access to a network and sourcing time. Once the candidate signs, the recruiter’s job is technically done, but your work has only just started.

- Contracts and compliance: You still need locally compliant employment contracts that reflect Indonesian labor regulations, including BPJS, tax, and mandatory benefits. Getting this wrong can expose you to disputes or back payments later.

- Payroll and administration: Every month, someone has to run payroll, issue pay slips, and handle statutory contributions correctly and on time. If you are operating from overseas, this often means building processes and tooling from scratch just for one country.

- Misclassification risk: If you try to “keep it simple” by treating engineers like contractors while expecting them to behave like employees, you move into a grey area. Over time, that can become a legal and reputational risk, especially as teams grow.

If these layers are not handled well, any savings you made on a lower upfront recruiter fee can be wiped out by clean‑up work, legal exposure, or early churn because the setup feels unclear or unfair from the engineer’s perspective.

To see how a clean remote‑work and legal structure in Indonesia can reduce these hidden costs and improve retention, you can also read How Remote Work Drives Cost Savings and Boost Business Impact in Indonesia.

When a Talent Partner is Usually Cheaper Then a Traditional Recruiter

A talent partner like RainTech works differently from a one‑off recruiter. Instead of optimizing for “filled roles”, it bundles sourcing, contract setup, payroll, and compliance into one integrated model.

- Team‑building vs one‑off placements: If your goal is to build a small Indonesian squad of two to five engineers over the next 12–18 months, it is more efficient to plan those hires as a roadmap, not as isolated events. A partner approach lets you reuse learnings, pipelines, and onboarding patterns from each hire, rather than paying a full per‑hire fee every time.

- No local entity required: When you do not have a local entity, you either need to set one up or use an EOR/compliance layer to hire properly. A partner that can combine talent sourcing with EOR and payroll removes the need to coordinate between multiple vendors and lowers the chance of gaps or conflicts between contracts and actual day‑to‑day work.

- Retention and stability: Engineers do not just stay because you hired them through a slick process; they stay because the offer, benefits, and employment experience feel clear and fair. A partner model can bake that thinking into the setup, instead of leaving you to figure it out piecemeal after the hire is made.

To understand how this affects timelines as well as cost, read From Months to Weeks: Time to Hire in Indonesia which explains how partner‑led hiring can reliably compress cycles to two to four weeks.

Pattern We See From Founders After Trying Recruiters or DIY

Founders who reach out to RainTech after using traditional recruiters or running fully DIY hiring often tell a similar story.

- Timeline: They have already spent 60–90 days posting roles, sourcing, and interviewing, sometimes across more than one channel. During that time, product and go‑to‑market work are frequently slowed down because leadership is busy in hiring mode.

- Cost: When they finally add the numbers, the cost per hire is not just the recruiter invoice or job board spend. It includes the value of leadership time, the opportunity cost of delayed product milestones, and sometimes the cost of rehiring after a miss‑hire or early churn.

- Realization: They eventually recognize that winning in Indonesia is not only about finding resumes. It is about having a partner who understands the market, sets realistic expectations, and helps build a structure that supports engineers and the business over the long term.

For a direct comparison of DIY, generic vendors, and RainTech as a dedicated partner, revisit Hire Your First 3 Indonesian Developers in 30 Days with RainTech

To understand why competition for Indonesian tech talent is intensifying and what strategies actually work, you can also explore Indonesia's Tech Talent Outlook 2025: Demand, Strategies, and Real Actions.

A Better Way to Calculate Your "True" Cost per Hire

To avoid being blindsided by the front‑end fee alone, it helps to break your cost per hire into four buckets:

- Recruiter / partner cost – per‑hire fees, retainers, or partner pricing.

- Internal time cost – hours spent by founders, HR, and hiring managers on sourcing, screening, interviews, and coordination.

- Legal and payroll setup and operations – cost of a local entity, payroll provider, or EOR model to employ engineers correctly.

- Risk cost – early churn, re‑hiring, contract rewrites, and potential compliance penalties.

Once you plug real numbers into each bucket, a lot of seemingly “cheap” options stop looking cheap, especially when you stretch the view over 12–24 months.

Models that bundle more of these layers: sourcing, contracts, payroll, and compliance, may look heavier in one line item, but they often reduce your total cost and risk over time.

Conclusion

“How much do recruiters charge to hire in Indonesia?” is a useful question, but the question that will actually protect your budget is: “Which structure gives me the healthiest total cost and lowest risk over the next 12–24 months?”.

If you truly need a single hire, already have a local entity, and are comfortable carrying legal and payroll risk, an agency recruiter can still be a valid option.

If you want to build a team of two to five engineers in Indonesia without setting up an entity, a talent partner that combines sourcing with payroll and EOR usually gives you a more stable, predictable cost base and a much clearer view of the risks you are actually taking.

To get a realistic view of what hiring in Indonesia will cost for your specific case: role, level, salary range, and 12‑month team plan, take the next step:

- Schedule a cost breakdown call with RainTech to compare traditional recruiters, DIY, and a talent‑partner model for hiring in Indonesia.

- Join RainTech’s newsletter to receive ongoing insights on hiring costs, salary trends, and legal/payroll structures for remote teams in Indonesia.

Reference:

- Kusuma Law Firm, Remote Work in Indonesia: Legal Framework, Tax Implications, and Best Practices for Businesses